This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Read More

Search here

Fintech & Banking Software Development Services

Boost financial innovation with secure, user-focused, and scalable fintech & banking solutions. At Nextige, we create custom fintech platforms, banking systems, and financial tools that meet compliance, performance, and trust needs.

- Secure, scalable fintech platforms for web & mobile

- Custom payment gateways & API integrations

- Compliance-ready solutions for finance & banking

Inquire Now

Home Industries Fintech & Banking

Why Fintech Clients Choose Nextige

Bank-Grade Security

Built-in compliance with PCI DSS, GDPR, SOC 2, and specific banking rules helps protect sensitive data.

Custom-Built Platforms

From mobile banking apps to trading platforms, we build fintech & banking systems designed for your users and business needs.

Scalable Architecture

Our cloud-based system, built with microservices, allows for high performance, simple scaling, and a worldwide presence.

Faster Go-to-Market

Using agile methods and short delivery cycles, we quickly create, refine, and launch effective fintech solutions.

Our Fintech & Banking Services

Digital Banking Platforms

End-to-end development of secure, scalable, and modern fintech & banking systems. This includes mobile apps, core banking platforms, and channels for customer interaction.

Payment Gateway

We use secure and compliant payment systems like Stripe, Razorpay, and Plaid to support smooth, real-time transactions across global and local networks

Lending & Credit Solutions

Digitize the lending process with automated underwriting, real-time credit scoring, loan management, and built-in KYC and AML compliance.

Wealth Management

Develop investment platforms, AI-based robo-advisors, and dashboard interfaces that help users track their portfolios, review performance, and invest more wisely.

Blockchain & Smart

Implement blockchain systems for decentralized finance, clear cross-border payments, and safe smart contract workflows.

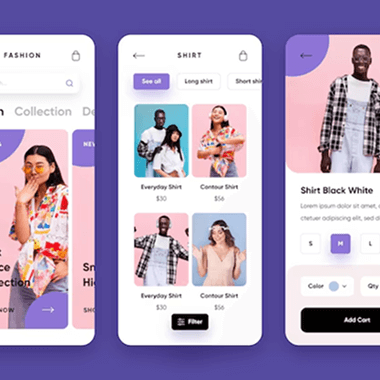

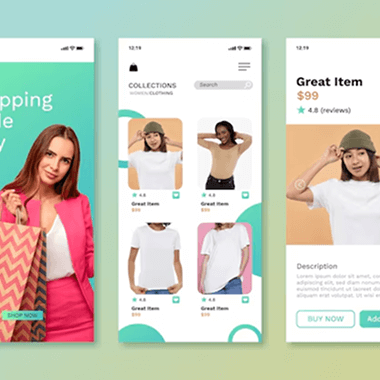

Fintech UX/UI Design

Create clean and easy-to-use fintech experiences that balance compliance, accessibility, and user engagement.

Let’s Build the Future of Finance

Partner with us to build secure, compliant, and user-centric fintech products.

Our Shopify Development Services

Integration Capabilities

At Nextige, we build fintech & banking solutions that integrate seamlessly with essential financial systems. From legacy banking software to modern cloud stacks, we connect your infrastructure for smarter operations and full regulatory compliance.

Core Banking Systems

Temenos, Finastra, Oracle FLEXCUBE & more

We work with reliable core banking platforms to provide secure, real-time account management and data synchronization across all channels, both digital and traditional

Payment Processors

Visa, Mastercard, Stripe, Razorpay, PayPal, PayU

Support multiple payment methods, including recurring billing, wallets, and cross-border transactions. Include fraud detection and tokenization.

Compliance and KYC Tools

Connect with tools for identity verification, transaction monitoring, and risk scoring. This helps your platform meet the latest AML and regulatory standards.

Tech Expertise

Java

Python

React

AWS

Azure

Docker

Twilio

Client Testimonials

4.9

5.0

Powered by

5.0

"Nextige was fantastic! Professional, patient with all my small requests, and incredibly helpful. Highly recommended."

Talia Sari Jewelry, Yoav Shafranek

4.5

"Nextige is great to work with. They do both web development and graphic design well. They are highly responsive, detailed, and go above and beyond. I will continue to work with them on future projects."

Madi Lineman Tools, Tye Burke

5.0

"Nextige was a pleasure to work with. Nextige helped refine the brief in order to understand what was important for our Shopify store and was diligent, ensuring we were happy with the final result."

Motofork, David Stache

Powered by

5.0

"Top quality, dedication to delivering good work, good comms, punctuality, and an eye for detail. Loved the whole project with Nextige!"

CEO, Christophe S.

4.5

"He's an excellent and super talented web developer. We've built a long-term relationship. I'd recommend it to anybody who needs stunning results. Thanks for everything again."

Agency Partner, Ephantus N.

4.5

"Absolutely stunning job! On time, and with good accuracy! They'd done an excellent job! I'm very happy to work with Nextige."

Product Owner, Ephantus N.

5.0

"This is the third successful project with Nextige."

Project Manager, Mohammed Z.

5.0

"I have done a couple of projects before with Nextige. I had a production bug with JS / CSS in a production application. So I needed it to be fixed quickly and good. Loved the way Nextige picked it up, checked it came up with a nifty solution."

Minebyte, Founder, Patrick Hira

4.5

"Nextige is easy to work with, and their team of developers are very knowledgeable."

1To1 Marketing Founder, Hoshang M

5.0

"Nextige and I have collaborated on three or four projects back-to-back. Nextige is a fantastic UI/UX design agency. I would suggest it to everyone."

CTO at Redline, Gaurav Sharma

FAQs

What security standards does Nextige follow in fintech apps?

Nextige follows well-known standards like PCI DSS, GDPR, and local financial regulations. We use data encryption, secure authentication, and compliance monitoring to make sure all fintech apps are safe, dependable, and ready for audits.

Do you build white-label banking platforms?

Yes. We provide white-label digital banking platforms that you can fully customize to show your brand. These include essential banking features, mobile apps, user onboarding, payment gateways, and flexible cloud infrastructure, all delivered with your name.

Can you help with compliance and audits?

Absolutely. Our team makes sure your fintech solution is ready for audits and meets compliance from the start. We offer built-in KYC and AML tools, automated reporting, and support for passing regulatory audits, including GDPR, PCI DSS, and SOC 2.